FXOpen

[Update August 21, 2020]

The Inside bar breakout strategy is a powerful price action strategy. Its distinction is the simplicity of application and good rewards it offers compared to the risk. Also, it allows us to get into trending moves. So, it is considered one of the greatest strategies applied in Forex trading.

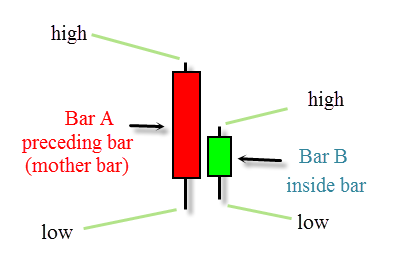

Structure of Inside Bar

An inside bar is actually a single bar (or candle) that is completely inside the preceding bar. For clarity, the entire price action of the inside bar (body and wicks) are covered and contained within the range of the previous bar. In the following illustration, we can see that the high of the bar B (inside bar) is lower than the high of the bar A (mother bar), and the low of the bar B is higher than the low of the bar A.

Illustration 1: structure of an inside bar

Inside bar with a small range

This is how standard inside bar is called, where the range of the candle is small and is overlapped by the previous candle. This inside bar pattern suggests that the market is dominated by low volatility and indecision.

Inside bar with a large range

If an inside bar candle is overlapped with the previous candle, but the range of the inside bar is large enough, you are looking at the inside bar with the large range. This type of inside bar may indicate both the indecision prevailing in the market and the reverse movement.

Multiple inside bars

Multiple inside bars that follow one another indicate that the market may soon explode with volatility. It is important to keep track of this pattern so that you do not miss a big market move.

Inside Bar Psychology

An important effect of any technical pattern is derived from its psychological meaning. When we want to detect the inside bar psychology, we will figure out that it represents a time of indecision or consolidation in the market, where neither the bulls nor the bears are in charge. The bears can’t make a lower low, and the bulls can’t make a higher high. Consequently, the inside bar formation occurs under the following circumstances:

- Price consolidation after a large up/down move before starting another round of movement in the dominant trend direction.

- Price facing a strong key level (support or resistance) which makes some hesitation in the market as to whether it will break the key level and continue or not and reversed.

- Ranging markets due to the lack of liquidity and the reduction of traders’ participation. Hence, we can consider the inside bar as a trend continuation signal and a reversal signal alike.

Illustration 2: Here we can see many inside bars which act as a continuation signal in-line with the dominant trend direction. And this offers us a great opportunity to be in the next leg of the movement after price consolidation.

Illustration 3: Here we can see an inside bar at a key support level that acts as a reversal signal, also an inside bar with a big mother bar, and an inside bar in the ranging market that we must ignore.

Trading the Inside Bar

It is important to realize that we cannot trade every inside bar profitably, so we must detect the reliable and accurate inside bars. In fact, the best setup for such a strategy is to trade only in the direction of the trend as a continuation signal, and trade only on a daily time frame. We must ignore the inside bars formed during the ranging markets and low liquidity.

Since we enter an inside bar trade as a continuation signal, we can take trades as follows:

Entry: we enter an inside bar on a breakout of the mother bar high or low. If the trend is up, we will place a buy stop entry order just above the mother bar high, and if the trend is down, we will place a sell stop entry order just below the mother bar low.

Stop loss: we place a stop loss order just above or below the mother bar high or low. If the trend is up, we will place stop loss order just below the mother bar low, and if the trend is down, we will place stop loss order just above the mother bar high.

If we trade inside bars with larger mother bars, we will place our stop loss near the mother bar 50% level (the midpoint) between the high and low of the mother bar. The tremendous advantage of this strategy is that it offers a small stop loss. Thus, it ensures a reasonable risk-reward ratio for the trader.

An example below is related to the USD/CAD Daily chart. We can see the trend which is clearly to the upside, this means that the bulls are in charge. And there are two inside bars which are in-line with the uptrend, resulted in the breakout continuation move. The price climbs up for about 250 pips.

Illustration 4: an example of the inside bar on the USD/CAD daily chart

The great thing about the inside bar strategy is that it gives us a good chance to get into trending moves. When we see an inside bar on our charts, it means that the traders are unwilling to move the price higher or lower. This situation is usually followed by increased volatility, which offers us a good opportunity.

The great thing about the inside bar strategy is that it gives us a good chance to get into trending moves. When we see an inside bar on our charts, it means that the traders are unwilling to move the price higher or lower. This situation is usually followed by increased volatility, which offers us a good opportunity.

Entries, stop loss, and exits when trading inside bars

We learned about how to how to trade inside bar method. Now let’s figure out how to manage entries, stops, and exits when using inside bar Forex indicators.

Entry

The best spot to enter the market with the inside bar strategy is to enter the mother bar price breakout in the trend direction. To do this, we place a stop order on the mother bar border. It is also possible to enter the market on the inside bar price breakout, but then the probability of false breakout increases.

Stop loss

With inside bars, there are two options for setting a stop-loss order.

- Placing the stop loss just below the mother bar minimum. This approach is safer but does not deliver the optimal risk/profit ratio.

- Placing the stop loss below the inside bar minimum. This approach not only provides the best risk/profit ratio but is also safe enough to place a stop loss.

It should be noted that support and resistance levels play an important role in determining whether to resort to the inside bar Forex strategy. Many traders make a mistake when opening their trades without clearly identifying support and resistance levels.

Exit

Your exit strategy depends on whether you want to ride the trend or capture a swing.

While capturing a swing, you must exit a trade before opposing pressure kicks in. For instance, if you have a long position, then sell at the resistance or swing high.

If you aim at riding a trend, then prepare to use trailing stop loss as the market moves in your favor.

What makes an inside bar worth trading?

Inside bar strategy has established itself excellently on the trend of the daily chart. With its help, you can search for market reversal zones. This happens rarely, of course, but an inside candle bar can show the entry points for trading against the trend. Most often, the internal bar emerges just before a natural market stop, with the subsequent resumption of a strong trend.

The inside bar is rational to use when a trend is in full force. With a fixed true breakout, the stop loss is recommended to set somewhere below the middle third of the outer or mother candle. You can also place the stop loss under or over the defining bar itself.

The article is written by Israa Shehata and is participating in the Forex Article Contest. Good luck!

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.